By Dhananath Fernando

Originally appeared on the Morning

The recent discussion on restricting tyre imports to boost local production, with the stated objective of saving USD outflow from the country, requires closer examination.

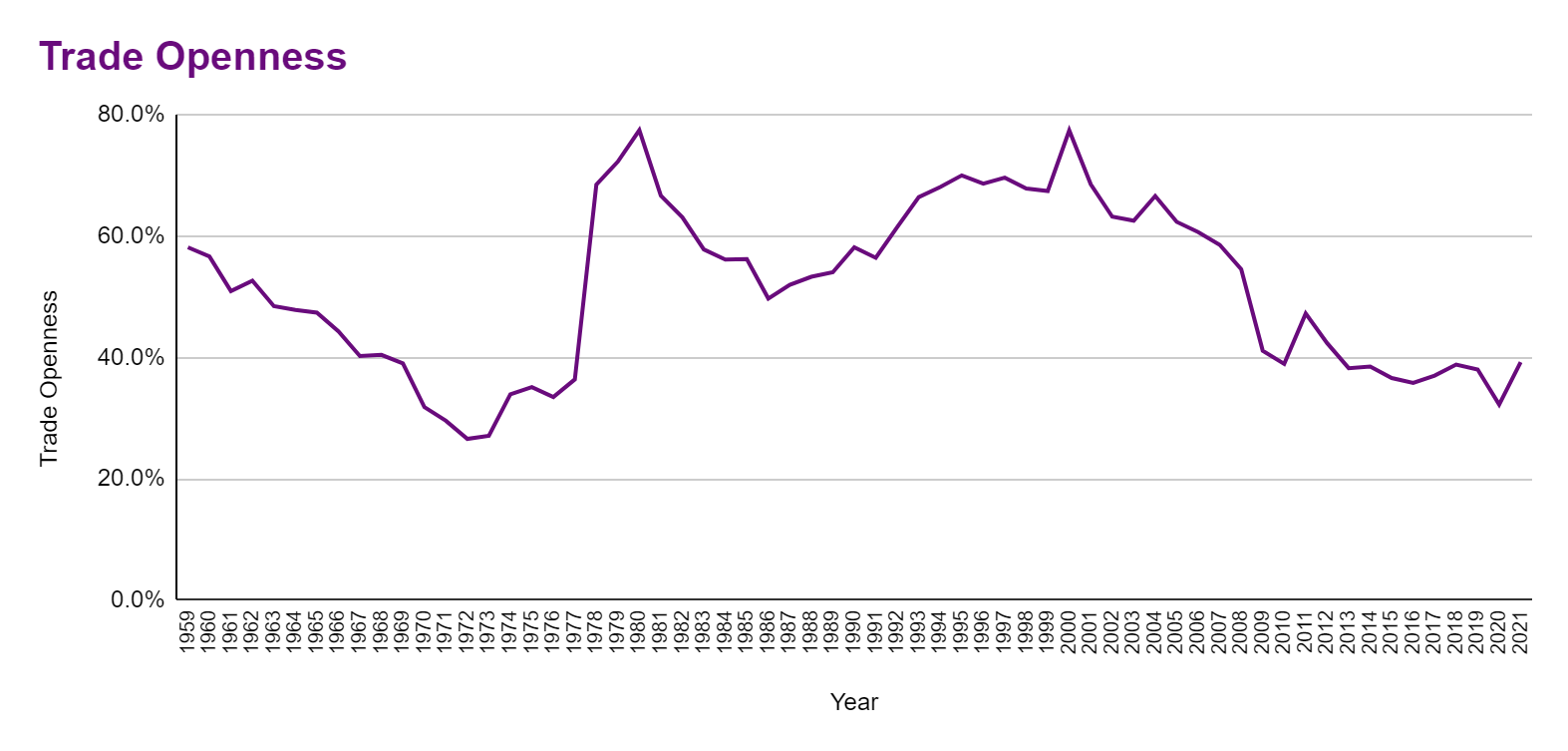

In Sri Lanka, import restrictions are often perceived as a measure to promote exports, but in reality, they have the opposite effect. Restricting imports discourages exports and reduces the productivity of local manufacturing.

Moreover, this strategy burdens consumers with higher prices and fosters corruption among Government officials and politicians. Ultimately, it is a strategy with no winners, leaving everyone worse off in the long run.

A deep dive into the tyre market

Sri Lanka is a leading exporter of solid tyres, holding approximately 25% of the global market share. Solid tyres, used in heavy-duty vehicles like tractors and forklifts, represent a key segment of our exports.

However, even as a global player in this industry, we rely on importing raw materials such as metal to remain competitive. Across all rubber products, Sri Lanka imports approximately $ 200 million worth of raw materials annually, as local rubber production is insufficient. In 2019, the total export value of rubber products was approximately $ 1 billion.

Typically, industries add about 30% value through their processes. In the case of pneumatic tyres, the current tariff structure includes a 20% general duty, a 10% Ports and Airport Development Levy (PAL), an 18% Value-Added Tax (VAT), a 25% or Rs. 330/kg Commodity Export Subsidy Scheme (CESS), and a 2.5% Social Security Contribution Levy (SSCL).

The cumulative tax burden amounts to 75.5% on paper, but due to the cascading effect of VAT applied on top of other taxes, the effective rate is significantly higher.

Sri Lanka has approximately five million vehicles, including tuk-tuks and motorcycles, which are often referred to as a ‘poor man’s transport’. These high tariffs or import bans effectively double the price of tyres, placing a disproportionate burden on ordinary consumers.

For instance, the tax relief provided by expanding the tax-free threshold from Rs. 100,000 to Rs. 150,000 results in a monthly saving of just Rs. 3,500 – an amount easily offset by the additional cost of a single tyre.

High tyre costs also drive up transportation expenses across the board, including bus fares, tuk-tuk fares, and freight costs, cascading through the economy without any corresponding productivity improvements.

Moreover, the new generation of Electric Vehicles (EVs) requires specialised, high-quality tyres. Import restrictions could limit access to these products, reducing the efficiency and viability of EV adoption in Sri Lanka.

Supporting local production the right way

Does this mean local production should not be supported? Absolutely not. However, support should come in the form of reducing structural barriers rather than imposing tariff protections.

For instance, the high cost of energy is a major driver of manufacturing expenses in Sri Lanka. Addressing this issue through energy sector reforms would make local products more competitive. Alternatively, the Government could share the risk by subsidising loan interest rates, enabling manufacturers to compete globally and focus on exports rather than relying on protectionist tariffs.

High tariffs only serve to make local production uncompetitive, forcing consumers to bear the cost of substandard products. Instead, removing barriers to business and fostering an export-oriented industrial strategy is the way forward.

The problem with CESS and import tariffs

The CESS was introduced by the Export Development Board (EDB) to encourage value-added exports and discourage raw material exports. Ironically, this tax on exports has been extended to imports, significantly inflating tariff burdens. Few people realise the original intent of the CESS and its unintended consequences on trade.

Debunking protectionist arguments

Two common arguments are often made in favour of high import tariffs:

Infant industry argument: The idea is that new industries require time to establish themselves. However, the tyre industry in Sri Lanka dates back to the 1970s – well past its ‘infant’ stage. After more than half a century, it should be thriving without protectionist crutches.

Comparisons to India and the US: While India and the US impose some high tariffs, these nations have vastly different contexts. India, with a population of over a billion, and the US, with 300 million high-income consumers, can leverage economies of scale to make protectionism viable. Even in these countries, protectionism has shown its limits, and they increasingly focus on global competitiveness.

The tragedy of corruption through protectionism

Another significant downside of protectionism is its susceptibility to corruption. Sri Lanka has already witnessed scandals such as the sugar and garlic scams, where the Special Commodity Levy (SCL) was manipulated overnight through ministerial powers.

Similarly, protectionist tariffs can be arbitrarily increased by corrupt officials, allowing certain companies to gain undue advantages. These benefits can even be funnelled into campaign financing, creating a vicious cycle of corruption.

The International Monetary Fund (IMF) Governance Diagnostic Report highlights the vulnerabilities associated with protectionism, emphasising how such policies open the door to corrupt practices. By simply raising tariffs, policymakers can distort market dynamics, favouring a few while imposing costs on the wider public. This undermines the principles of fair competition and good governance.

The misguided USD savings argument

The notion that import restrictions save USD is flawed. Imports are driven by the ability to borrow in LKR rather than by direct dollar demand. With an appreciating currency and improving reserves, Sri Lanka has imported more without destabilising its economy. Restricting tyre imports could inadvertently increase wear and tear of other spare parts, like shock absorbers and rubber bushes, leading to higher overall costs.

If Sri Lanka continues to pursue import bans as a strategy to develop industries, it risks destroying exports, raising the cost of living, and undermining local industries’ competitiveness. Instead, we should focus on removing barriers to business and enabling local manufacturers to compete globally.

Protectionism not only creates losers but also fosters corruption, making it an unsustainable and counterproductive strategy. A competitive, export-driven approach benefits everyone, ensuring a prosperous future for the economy.