By Dhananath Fernando

Originally appeared on the Morning

In two weeks, a newly-elected president and government will take charge of steering the country.

At the beginning of the forex crisis, we warned that an economic crisis often comes as a package of five interconnected crises.

Balance of payments crisis

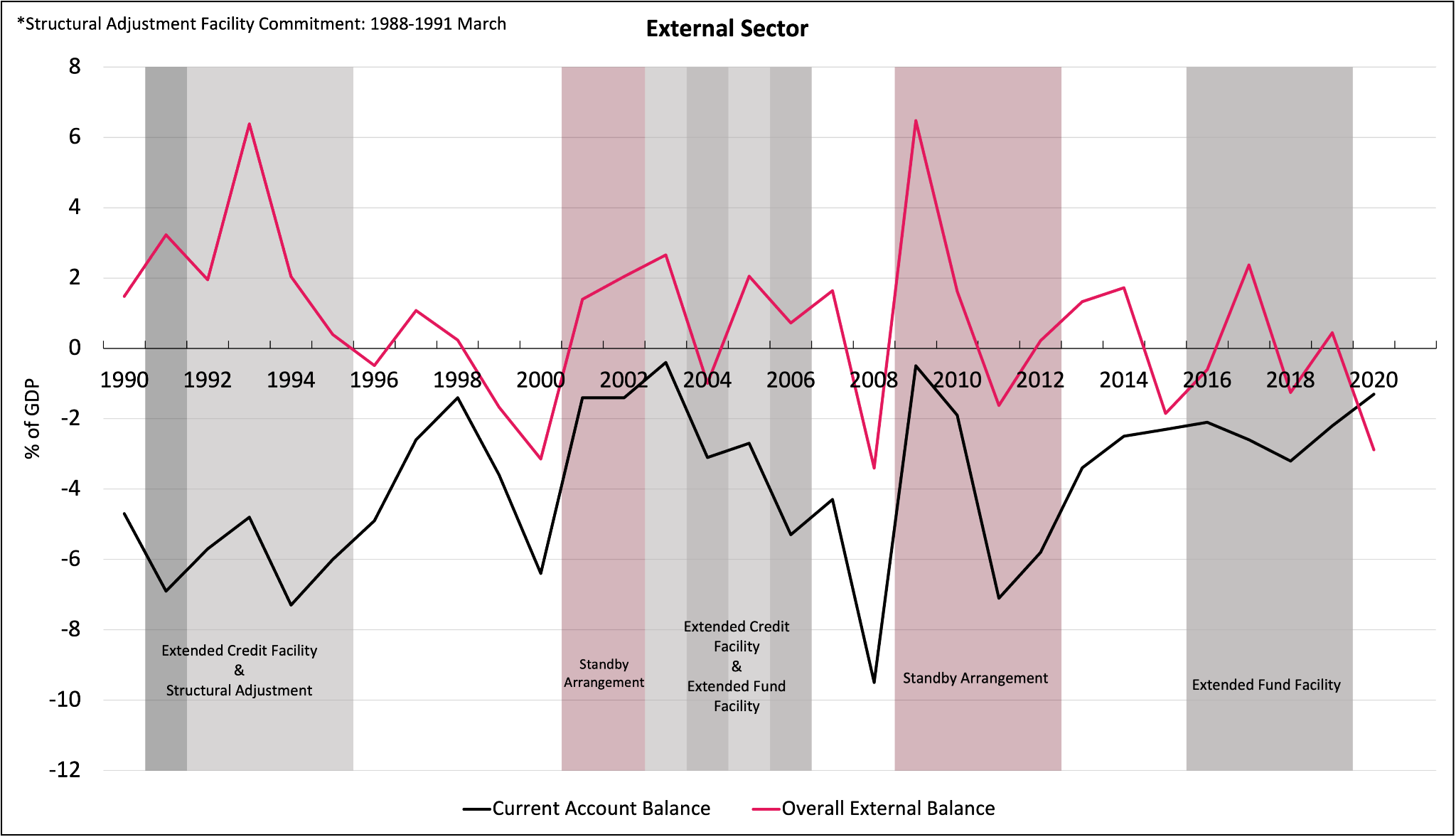

A balance of payments crisis occurs when excessive borrowing from the central bank (money printing) leads to inflation. In countries like Sri Lanka, where the local currency is not a reserve currency and the economy relies heavily on imports, printing too much money increases the demand for goods and services – many of which are imported.

If exports, remittances, and Foreign Direct Investments (FDI) fail to keep up with this increased demand for imports, we run out of foreign exchange reserves, causing the currency to depreciate.

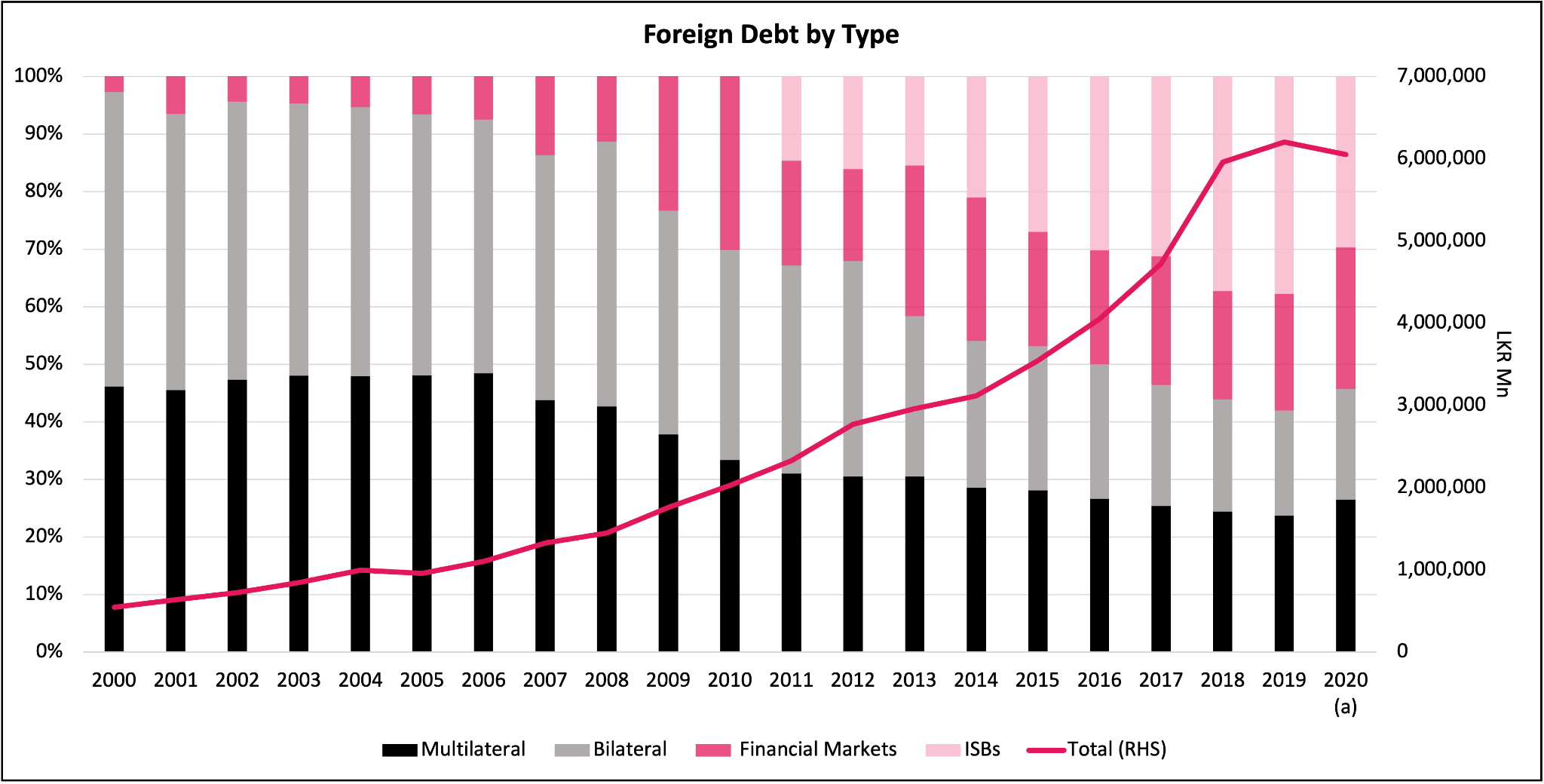

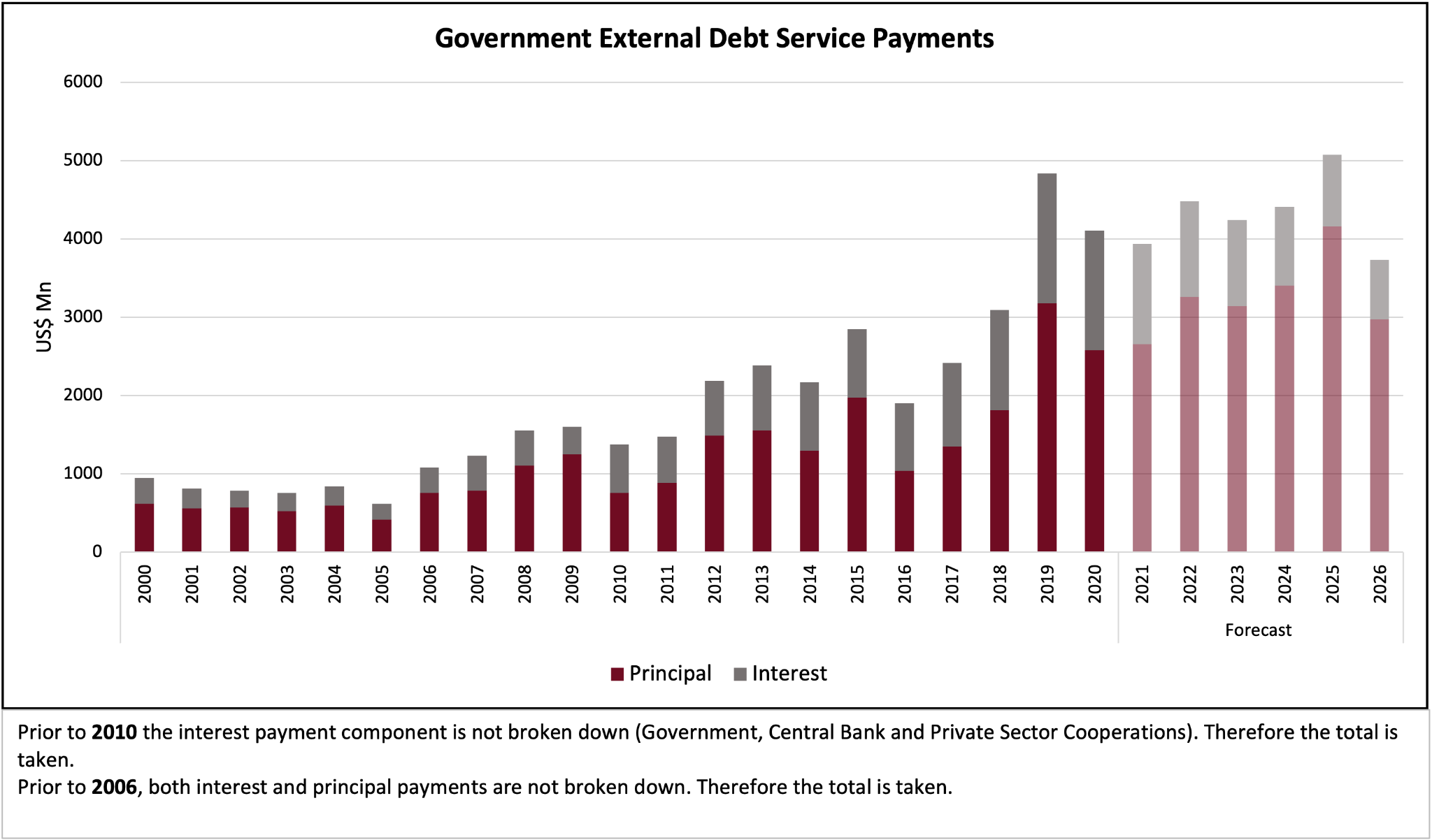

Debt crisis

When foreign currency reserves are depleted, the country struggles to meet its obligations to creditors. While borrowing from international markets might offer temporary relief, credit rating downgrades make this option limited, triggering a debt crisis. On 12 April 2022, Sri Lanka officially declared it could no longer service its debts, despite having the intention to do so.

Banking crisis

If local banks have provided significant loans to the government and the government defaults, a banking crisis can unfold. Sri Lanka narrowly avoided this scenario.

Humanitarian crisis

With debt defaults and depleted foreign reserves, imports become limited. Inflation makes basic necessities unaffordable for the poorest segments of society. In Sri Lanka, poverty numbers surged from three million to seven million, pushing more than 30% of the population below the poverty line.

Political crisis

When a government faces multiple crises such as these, political instability inevitably follows, as we have seen in Sri Lanka. The President was ousted, the Prime Minister and Finance Minister resigned, and an interim Government was formed.

Although the political crisis continues, it is only one phase in an ongoing cycle of instability, with the Presidential Election being a milestone in this process.

Current political landscape

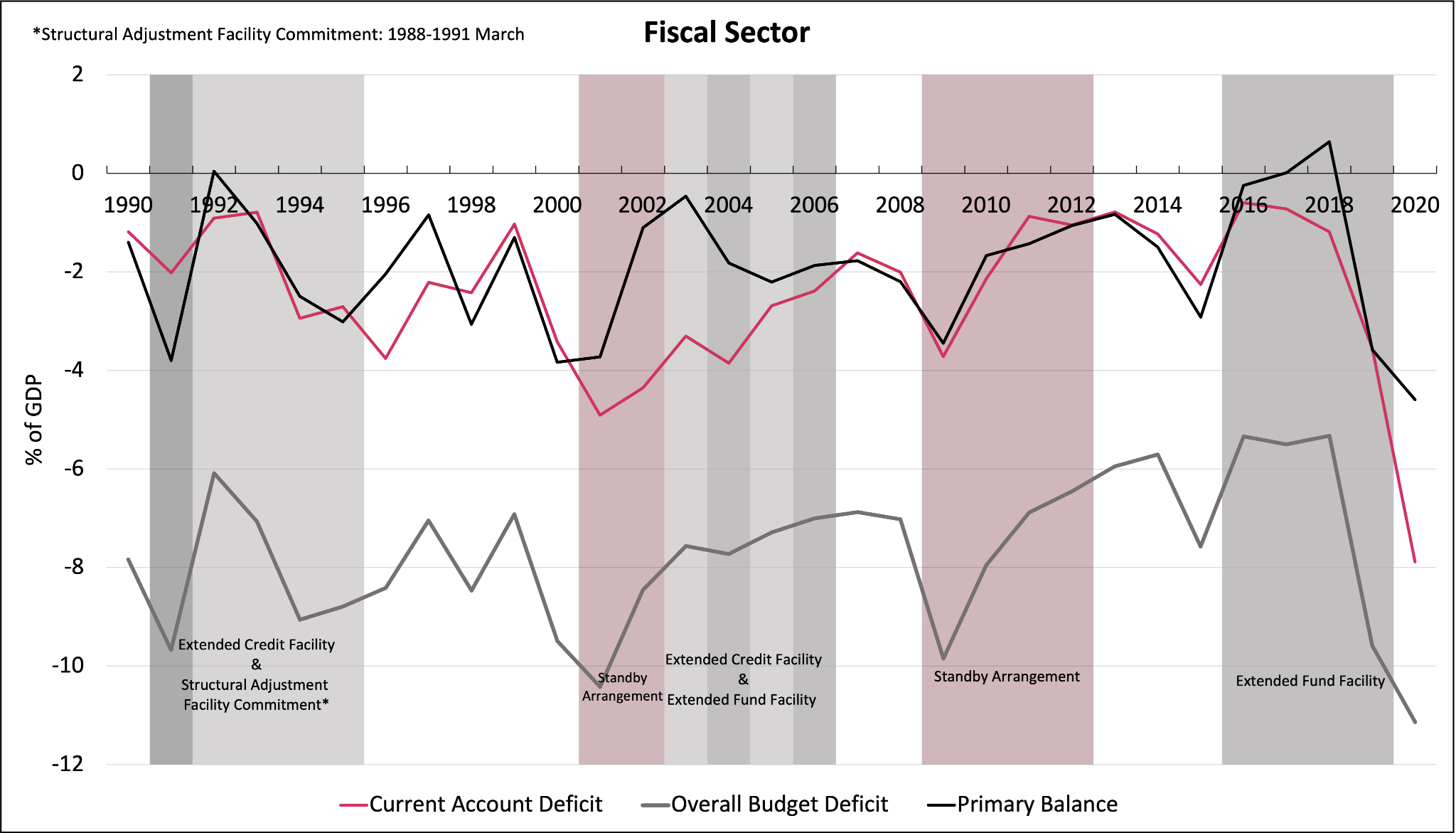

The incumbent President has introduced significant relief measures, including raising public sector salaries, forgiving agricultural loans, and making other promises. However, if re-elected, he will struggle to deliver on these promises within the limited fiscal space, potentially leading to a deviation from the International Monetary Fund (IMF) programme.

Alternatively, he might be forced to raise taxes or borrow more, which would increase interest rates and add to the economic strain.

If another candidate is elected, they will face the same fiscal limitations and may have to reverse salary increases to maintain fiscal discipline.

In the case of a Samagi Jana Balawegaya (SJB) government, the challenges are compounded. The Economic Council within the SJB sends mixed signals about achieving revenue targets to support proposed expenditures. Additionally, the broad alliance of political factions under the SJB presents internal challenges, especially concerning sensitive reforms like State-Owned Enterprise (SOE) restructuring and maintaining Central Bank independence.

Not all factions have aligned views based on previous voting records and public statements. Managing these internal differences will be critical for an SJB government, especially in the context of carrying forward the relief measures introduced by the current President.

Similarly, in a National People’s Power (NPP) government, the same challenges apply. The NPP, primarily led by the Janatha Vimukthi Peramuna (JVP), advocates for a more State-led development approach, but many professionals in the party’s outer circle lean toward market-driven policies. This could lead to internal conflict, making reforms difficult to implement without alienating part of the party.

This situation resembles the ‘Yahapalana’ Government, where the President and Prime Minister held differing ideologies. As a result, governance became more about managing stakeholders than effective government operation.

If you recall, the Prime Minister made economic decisions through the Cabinet Committee on Economic Management (CCEM), which was later replaced by the National Economic Council appointed by then President Maithripala Sirisena. Stakeholder management within an NPP government could prove just as challenging.

On top of these internal struggles, Parliamentary and Provincial Council Elections are expected to follow, adding even more political promises that will further constrain the fiscal space. Reforms tend to slow down during election periods, making debt restructuring more difficult and putting the IMF programme and long-term debt sustainability at risk.

While we may see temporary relief from one or more of these crises, the interconnected nature of these issues means that one crisis could easily trigger the others. The risk factors remain extremely high, underscoring how difficult and sensitive sovereign debt restructuring and recovery can be. There is always a risk of setbacks before we see real progress.

The path forward

Whoever takes office, the best-case scenario involves continuing with reforms aimed at growing the economy, with all political parties supporting these efforts with transparency and accountability.

Stakeholder management will be crucial, but there is no other way to avoid the complete package of five crises. Economic growth, fiscal discipline, and political unity are essential if Sri Lanka is to emerge from this difficult period.