By Dhananath Fernando

Originally appeared on the Morning

If you ask the average person the reason for our economic crisis, they would probably say one word: ‘corruption’. The idea of corruption was hyped so much that it became the main theme of the people’s movement – the ‘Aragalaya’.

However, the truth is a little different. This doesn’t mean there hasn’t been corruption; it means corruption is more of a symptom than the root cause. Corruption is like a fever, while the real infection lies elsewhere. The problem is, we don’t fully understand how corruption occurred, and if we don’t know that, it’s unlikely that we can fix it either.

Even when we look at the election manifestos of political parties, they talk about eliminating corruption, but corruption isn’t the main focus. Instead, they place more emphasis on proposals for exports, business environment reforms, social safety nets, and debt restructuring.

Why don’t we know?

The way many Sri Lankans calculate corruption is simple: they take the total value of loans we have taken over the years, compare it with the asset value of infrastructure projects, and conclude that the difference equals corruption.

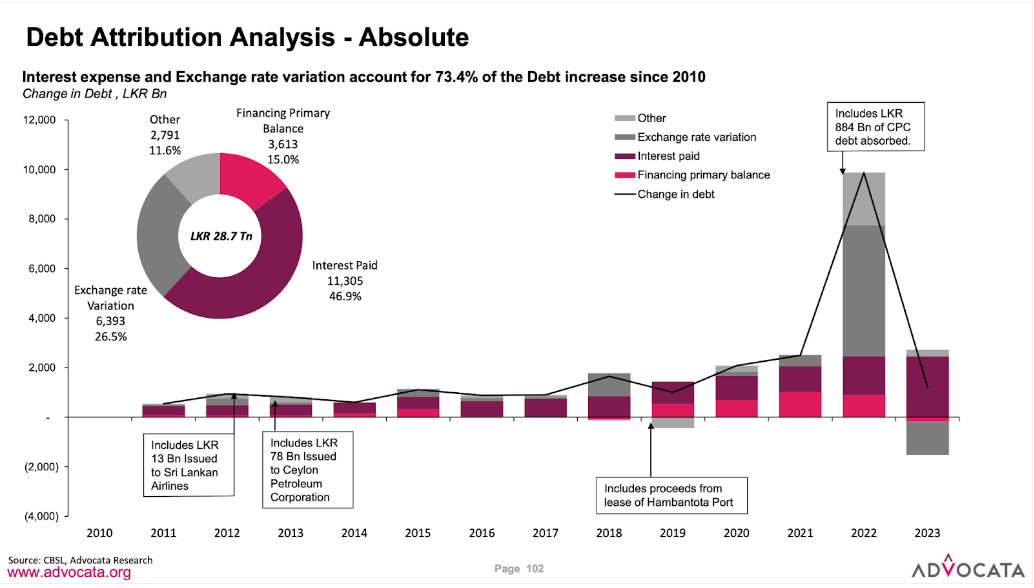

However, most of the money we borrowed was not for infrastructure. In fact, since 2010, about 47% of the loans were taken just to pay interest. Another 26% of the debt increase came from currency depreciation. This means that from 2010 to 2023, about 72% of the total loans was used for interest payments and dealing with currency depreciation.

Therefore, comparing the value of infrastructure projects to the total debt doesn’t give a clear picture of corruption because we have been borrowing mostly in order to pay interest. As a result, the debt keeps growing and we remain stuck in the same place.

Does that mean there’s no corruption?

This doesn’t mean there has been no corruption. It simply means we don’t fully understand how it took place. As a result, the solutions proposed for corruption only address the symptoms, not the root cause.

Corruption has taken place during procurement. Most of the projects we conducted have been priced far above their actual value.

For example, a project that should have cost $ 1 million was priced at $ 3 million. We then borrowed money at high interest rates for that inflated amount. The project is completed, but we’re still paying interest on an inflated value and the interest keeps snowballing. Now, we’re borrowing more just to pay the interest, which only pushes the total debt higher.

How to fix it

This problem needs to be fixed at the beginning, not at the end. Most anti-corruption methods focus on the aftermath – finding thieves and recovering stolen money. Of course, we should recover stolen money and hold people accountable for misuse of public funds. But on a policy level, the real need is for transparency in procurement and competitive bidding.

Digital procurement systems and a proper procurement law can take us to the next stage. Otherwise, it’s akin to closing the stable door after the horse has bolted. Without competitive bidding, we may never even know the true value of projects or how much was stolen. Recovering stolen money becomes incredibly difficult if we don’t know the amount or the method used to steal it.

The solution is upfront disclosure of the values of large infrastructure projects, as well as clear financing methods and guidelines.

The graph shows the impact of State-Owned Enterprise (SOE) losses on debt. The contributions of Ceylon Petroleum Corporation (CPC) and SriLankan Airlines to the debt are clear; in 2024, we will see more debt from SriLankan Airlines, the National Water Supply and Drainage Board (NWSDB), and other entities.

Simply put, we borrowed too much at high interest rates with short maturities for infrastructure projects that didn’t generate enough revenue to even cover the interest payments. As a result, the interest compounded and we have been continuously borrowing to pay off that growing interest, leaving the debt in place and forcing us to keep borrowing.

Albert Einstein put it wisely when he said: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”