By Dhananath Fernando

Originally appeared on the Morning

Sri Lanka’s new Government faces critical early decisions

The first 100-200 days are critical for any new government. Being prepared to assume power is essential because if a government expects to prepare after getting to power, it risks being overtaken by circumstances.

This is particularly true in a country like Sri Lanka, where uncertainty is the only constant. Governments here face numerous internal and external shocks, and there is little time to prepare or adjust once in power. When a new president or government takes charge, it is akin to boarding a fast-moving train.

Many previous governments have been reactive, merely responding to crises rather than controlling the situation. If a new government fails to take command, the situation will inevitably take control of it.

During his second term, President Mahinda Rajapaksa’s Government was overtaken by corruption and inefficiency before it could address core issues. The ‘Yahapalana’ Government came to power unprepared, only drafting its Vision 2025 plan after a Cabinet reshuffle, including changes to the Ministry of Finance. By then, its primary mandate for rule of law, good governance, and economic transformation had already faded.

President Gotabaya Rajapaksa’s Government faced the unexpected Covid-19 pandemic. While somewhat prepared, its policies were misaligned with sound economic principles. The more policies it implemented, the more unpopular it became, given the delicate balance between economics and politics.

Learning from these past lessons, one hopes the current Government avoids the same mistakes. Its challenge is navigating back-to-back elections. While elections may strengthen the Government’s political power, delaying essential economic reforms could be disastrous for a fragile economy like Sri Lanka’s. Delays in reforms could take years to recover from, and in the meantime, other pressing issues may spiral out of control.

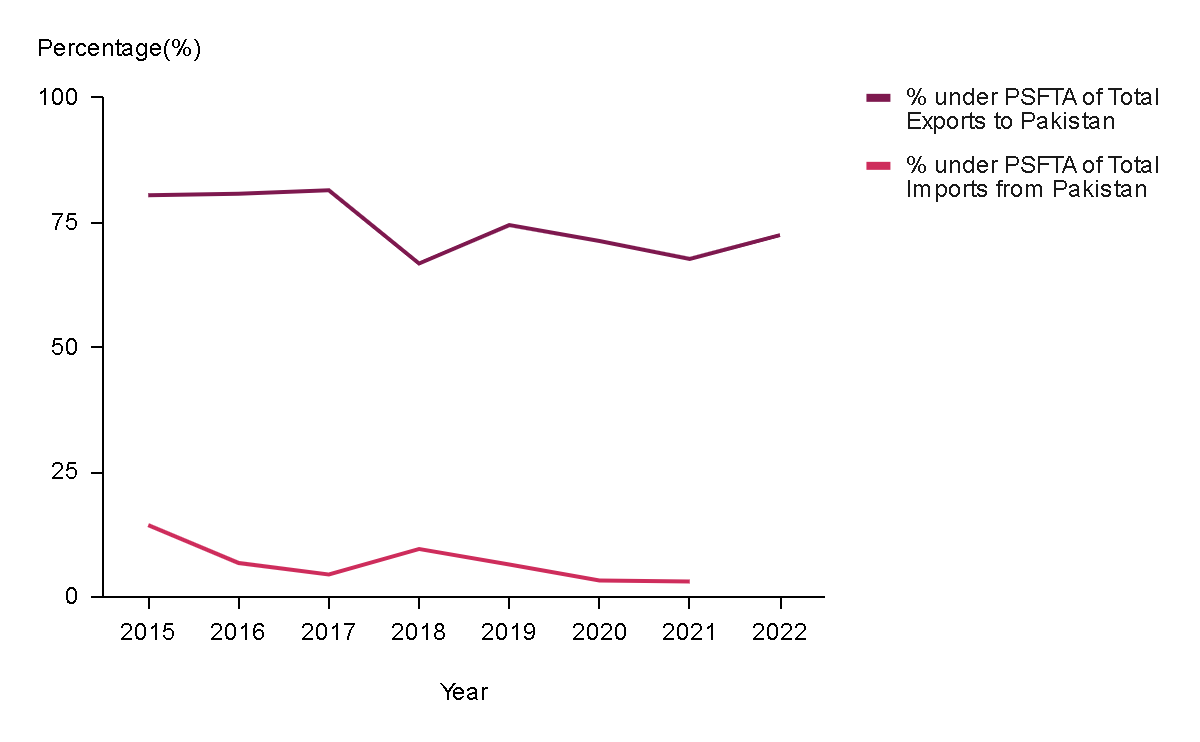

While the plan for economic stability continues, economic growth reforms are equally vital. According to the National People’s Power (NPP) manifesto, simplifying the tariff structure is a good starting point. A simplified tariff would not only boost growth and competition but also reduce corruption, benefiting consumers by lowering prices. The Government should see an increase in revenue as informal money leaks caused by a complex tariff system decline.

However, timing is crucial, and reforms need to be implemented quickly within the first 100-200 days. Simplifying the tariff structure will see resistance from trade unions and stakeholders benefiting from the corrupt system. The best way to minimise resistance is to act early. Some local companies, which profit from targeting only the domestic market, may resist the changes, as will officials who have benefitted from the complexity of the system.

The second key reform the new Government should prioritise is anti-corruption. In fact, it received a strong mandate for this. While addressing corrupt politicians and officials is important, the Government also needs to reduce the potential for future corruption by adjusting or removing certain regulations.

Even if the Government is not entirely prepared to tackle corruption vulnerabilities, the International Monetary Fund (IMF) Governance Diagnostic is ready with specific actions, responsible divisions, and timelines. By committing to this framework, Sri Lanka can also secure financial and technical support from bilateral and multilateral sources. More importantly, it would significantly reduce the country’s corruption vulnerabilities.

The Government must also avoid certain pitfalls. Delaying economic growth reforms in favour of focusing solely on anti-corruption would be a mistake. Both reforms need to move forward simultaneously, and the Government must be proactive rather than reactive.

Another mistake to avoid is the overuse of relief packages and price controls. When governments fail to deliver on promises, they often impose price controls as a last resort, covering everything from eggs and milk powder to hotel rooms. While intended to protect consumers, price controls often lead to unintended consequences. If the controlled price is lower than production costs, sellers lose the incentive to sell, creating black markets.

We hope the Government can maintain stability, grow the economy, and continue its anti-corruption drive in parallel. Failing to do so will only lead to further losses for all.