By Ashanthi Abayasekara and Yasmin Raji

A glance at Colombo’s (and suburban) housing prices will quickly establish that buying or renting a house is expensive for a vast majority of Sri Lankans. Advocata Institute in a study found that 70% of Sri Lankans cannot afford to own even a basic 500 square foot house in their lifetime. But what is driving up urban housing prices making house ownership unaffordable?

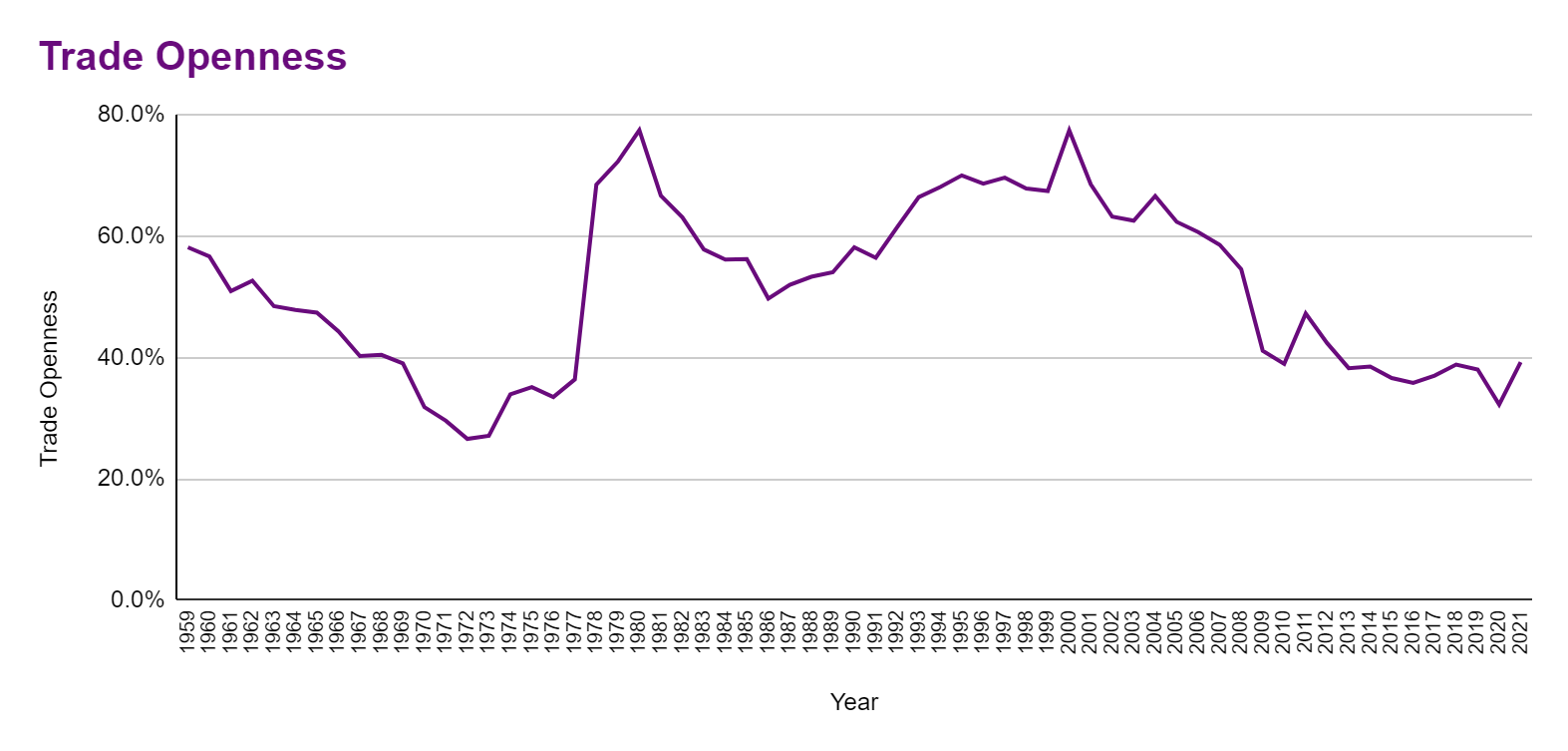

A recent study by Advocata Institute on the ‘Impact of Anti-Competitive Practices in the Construction Industry on Affordable Housing in Urban Sri Lanka’, reveals that urban housing prices are inflated partly due to restrictive trade policies and anti-competitive practices in the markets for housing construction materials.

The study examined the tiles, cement, and aluminum markets, all essential inputs in urban housing construction. These industries were found to be highly concentrated, with few firms involved. Barriers to entry are high due to substantial capital requirements and the need for economies of scale, which new entrants cannot afford. Additionally, market players benefit from significant trade protection through high import tariffs, cementing the dominance of domestic players.

In the case of domestically produced cement, the raw material used in the production of cement, clinker, has been subjected to a cumulative tariff ranging between 16% and 25% from 2014 to 2022. In comparison, importers of bulk and bag cement—the direct competitors of domestic manufacturers—have faced an additional para tariff of CESS consistently over the same period, ranging between 8% and 14%. This put cumulative tariffs for bulk and bag importers significantly higher than for clinker importers, ranging between 27.5% - 38.5% and 26% - 32.5% for bulk and bag cement importers respectively..

Figure 1: Changes to quantity of cement imported, prices, and tariff structures

A similar situation can be observed in the tile market, where imported tiles have been subjected to a total tariff rate ranging between 79% and 89.5% from 2013 to 2022 while tile raw materials were only subjected to a VAT of 8%. This discrepancy in tariff rates creates an uneven playing field, giving domestic manufacturers an unfair advantage over their importing counterparts.

In addition to the high border tariffs, quantity restrictions have also been utilized to curtail imports. This was predominantly observed in the sweeping import restrictions imposed in April 2020 owing to the foreign exchange shortage prevailing at the time. This saw the quantity of bag cement imported reducing by 65% and tiles reducing by 87%. While most of these restrictions were placed as an attempt to conserve foreign exchange during the forex crisis, the inconsistent way in which these policies have been implemented has disproportionately benefited the larger domestic players in the markets.

Apart from its implications on the producers and importers of construction materials, the high border tariffs coupled with import suspensions (protectionist trade policies) have resulted in a limited supply of construction materials available for customers, not only limiting their choices but more importantly, driving up the prices of goods exponentially. For example, high tariffs and import restrictions in the tile market led to customers being subjected to price increases of 93%-123% by August 2022 compared to April 2020. Customers also reported waiting times of over a year to receive the goods.

So how does all of this impact housing affordability? With rising prices of construction materials due to these protectionist trade policies and the lack of competition in the domestic market, the cost of constructing a house has also seen a significant increase over the years, making it unaffordable to a vast majority of Sri Lankans.

Given these impacts on necessities like housing, the corrective action would be to abolish tariffs altogether as soon as possible, and boost competition in construction material materials. However, due to Sri Lanka’s constrained fiscal space, reducing tariffs and removing trade restrictions should be done gradually. This approach will steadily increase the import of these goods, boost their supply, gradually drive down prices, and ultimately minimize housing affordability issues.