In this weekly column on The Sunday Morning Business titled “The Coordination Problem”, the scholars and fellows associated with Advocata attempt to explore issues around economics, public policy, the institutions that govern them and their impact on our lives and society.

Originally appeared on The Morning

By Sumhiya Sallay

Sri Lanka’s debt-to-GDP ratio is at a staggering 82.9% as of 2018, an increase from 76.9% in 2017. While the Ministry of Finance projects that these ratios will decline in the future, achieving these targets is of the utmost importance.

With a new Government in place, the country can expect to see new projects and policies introduced as the Government works on achieving their campaign promises. It is crucial that our loan commitments are a constant point of reference in this postelection period, where policies and projects that would shape Sri Lanka for the next four years are being evaluated and decided upon.

Our new title of upper middle-income country recognises the economic growth we have witnessed as a country. The challenge that lies ahead is sustaining this growth and clearing this hurdle of debt.

What can we do about our debt?

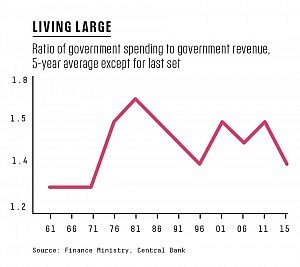

Total government debt is currently 82.9% of GDP, with the total debt service amounting to 14.5% of GDP. Government revenue as of 2018 was Rs. 1,920 billion, while government expenditure was Rs. 2,693 billion. The shortfall is clear, the Government has to borrow and borrow extensively to keep the country running. To elaborate further, the amount of money spent on debt servicing in 2018 amounted to 108.8% of government revenue. What is more alarming is the fact that the revenue-to-GDP ratio of Sri Lanka is one of the lowest in the world, and with the fast-growing emerging market economy, this brings much concern.

Bringing our debt-to-GDP ratio down will be challenging. The country will have to commit to a clear and stable monetary policy and maintain investor confidence. If these conditions are coupled with nominal growth in the economy, the result would be a fall in our debt-to-GDP ratio.

Of course, this is easier said than done, and borrowing from Peter to pay Paul is not a solution in and of itself. This needs to be accompanied with strong fiscal policy to ensure that the country gets a better grip on its finances.

Addressing expenditure

Given the recent tax cuts, it is clear that the country will have to balance this decrease in tax revenue with a corresponding decrease in government expenditure. The question is: How does a government manage their debt, taxes, and expenditure in a way that allows for economic growth while avoiding prohibitive rates of taxation?

Simply, some compromises have to be made and a delicate balance struck.

In order to achieve this balance, it is vital that we move away from ad hoc policymaking and the Government plans and works within a medium-term policy framework. In other words, the country needs to adopt a well-planned medium-term expenditure framework. This would mean that the Government would be able to plan projects and programmes taking into account a three-year resource envelope and fiscal obligations aligned with the allocated annual budget which would provide productive financial outcomes. This encourages the fiscal management of the Government’s revenue and expenditures, and thus helps control debt.

A medium-term expenditure framework (MTEF) sets out a rigid budget plan within which the Cabinet and central agencies ensure fiscal discipline when allocating public resources. This approach would set fiscal targets and allocate resources for strategic priorities within these targets, thus forming the basis of national priorities and expenditure prioritisation.

The MTEF aims to improve inter and intra-sectoral resource allocation by effectively prioritising all expenditures according to the Government’s socioeconomic programmes and committing towards allocating resources to only the most important projects.

This approach would monitor current expenditure estimates of policies and programmes and form a reference point for the upcoming years’ budgets. A MTEF would pave the way for policy and funding changes and thereby give time for ministries and agency managers to adjust and make better plans for their operations.

While following a MTEF is important, the Government could look at economic policies that would need adjustments to allow the country to repay loans, such as diversifying the labour market, supporting micro to macro businesses, re-regulating SOE finances, etc.

The Government could also create a policy environment that would encourage investment. While there are clear strategies that could be followed to manage our debt, this should be at the top of the new Government’s agenda, and our debt situation should guide policies on expenditure, borrowings, and taxation.

The Ministry of Finance projects that the country’s debt-to-GDP ratio will decline in the coming years, with an expected drop to 72% of GDP in 2022, but this is wholly dependent on Sri Lanka putting in place and adhering to a sustainable fiscal policy. Sri Lanka has an opportunity to overcome this challenge and it is vital that we grab this opportunity and adopt necessary policies.