From Dailymirror.lk:

According to the minister, a top corporate sector CEO has also been appointed to lead the Public Enterprise Board but fell short of disclosing who the official was. The minister said he was in the audience leaving the participants to guess.

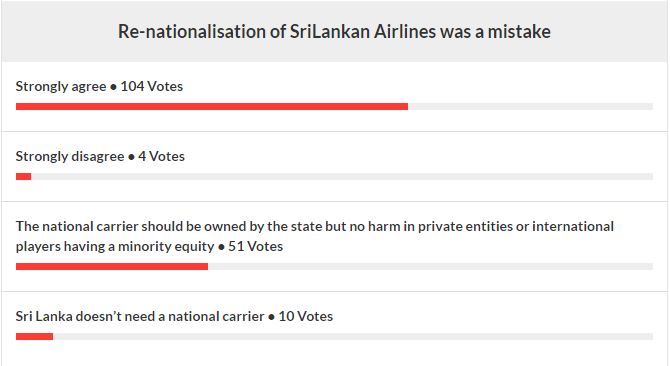

According to Advocata, an independent policy think tank, 55 strategically important SoEs in Sri Lanka have made a cumulative loss of Rs.636 billion during 2006 and 2015. The cumulative profit of the profitable SoEs during the same period has been Rs.530 billion, excluding the Employees’ Trust Fund. The statement by the minister suggests that the government is ready to go the whole hog in privatizing both the strategic as well as non-strategic SoEs despite the immense political risk forthcoming. Speaking at the final session under the theme titled, ‘The Future of Public Enterprises’ Samarawickrama said the government had reached the final leg of entering into a public-private partnership (PPP) to restructure the loss-making national carrier, SriLankan Airlines but did not disclose the party involved.

Meanwhile, Chief Opposition Whip and Janatha Vimukthi Peramuna Leader Anura Kumara Dissanayake said if the government could take over the liabilities of SriLankan Airlines prior to the sale of the carrier to a private party, they should also be able to take over the assets and run the airline.

From EconomyNext.com

SOEs were used to give off-budget subsidies and they borrowed from banks, pushing up interest rates and depriving funds and raising the borrowing costs of small enterprises.

Although some SOEs made profits, they do not reflect the returns for the investments made. Anushka Wijesinghe, Chief Economist at the Ceylon Chamber of Commerce, said that a report by Advocata, an independent think tank, found that from 2006 to 2015 it cost taxpayers Rs640 billion.

A part of the losses made by SOEs were financed by the budget.

"That means the government has to find tax revenues. Or else, the government has to borrow the money domestically or from abroad.

"These debts also have to be repaid by the people through future taxes. One way or the other the people have to bear the financial cost of these losses."

Advocata Institute's Report on SOEs is available in our research section.